Cryogenic Quantum Computing Hardware in 2025: Pioneering Ultra-Low Temperature Breakthroughs for Quantum Advantage. Explore How Next-Gen Cryogenic Platforms Are Shaping the Future of Quantum Processing and Commercialization.

- Executive Summary: 2025 Market Landscape and Key Drivers

- Core Principles: Cryogenics in Quantum Computing Explained

- Leading Players and Strategic Partnerships (e.g., ibm.com, intel.com, delft.cqte.nl)

- Current Hardware Architectures: Superconducting, Spin Qubits, and Beyond

- Cryogenic Infrastructure: Dilution Refrigerators, Control Electronics, and Integration

- Market Forecasts: Growth Projections Through 2030

- Emerging Innovations: Materials, Miniaturization, and Energy Efficiency

- Commercialization Pathways: From Research Labs to Scalable Deployment

- Regulatory, Standardization, and Industry Initiatives (e.g., ieee.org, qutech.nl)

- Future Outlook: Challenges, Opportunities, and the Road to Quantum Advantage

- Sources & References

Executive Summary: 2025 Market Landscape and Key Drivers

Cryogenic quantum computing hardware is poised to remain a cornerstone of quantum technology development in 2025, driven by the need for ultra-low temperature environments to enable stable qubit operation. The market landscape is shaped by rapid advancements in dilution refrigeration, cryogenic control electronics, and integrated system design, as leading quantum hardware companies and specialized cryogenics manufacturers intensify their efforts to scale up quantum processors.

Key players such as IBM, Bluefors, Oxford Instruments, and Quantum Design are at the forefront, supplying the dilution refrigerators and cryogenic platforms essential for superconducting and spin qubit systems. IBM continues to expand its fleet of quantum processors, with its 2025 roadmap emphasizing the deployment of larger-scale, error-corrected quantum systems, all of which rely on robust cryogenic infrastructure. Bluefors and Oxford Instruments are recognized for their high-reliability dilution refrigerators, which are now being optimized for higher cooling power, lower vibration, and increased automation to support multi-qubit scaling and 24/7 operation.

The demand for advanced cryogenic hardware is further fueled by the push toward quantum advantage and commercialization. In 2025, the integration of cryogenic microwave components, low-noise amplifiers, and scalable wiring solutions is a key focus, as companies seek to minimize thermal noise and maximize qubit coherence times. Bluefors has introduced modular cryogenic platforms designed for rapid deployment and compatibility with a range of quantum processor architectures, while Oxford Instruments is investing in automated cryogenic systems to reduce operational complexity and downtime.

Looking ahead, the market is expected to see increased collaboration between quantum hardware developers and cryogenics specialists, with joint efforts to standardize interfaces and improve system integration. The emergence of cryo-CMOS control electronics, being developed by both established semiconductor firms and quantum startups, is anticipated to further streamline the hardware stack and reduce the thermal load on dilution refrigerators. As quantum computing moves closer to practical applications, the reliability, scalability, and cost-effectiveness of cryogenic hardware will be critical market drivers through 2025 and beyond.

Core Principles: Cryogenics in Quantum Computing Explained

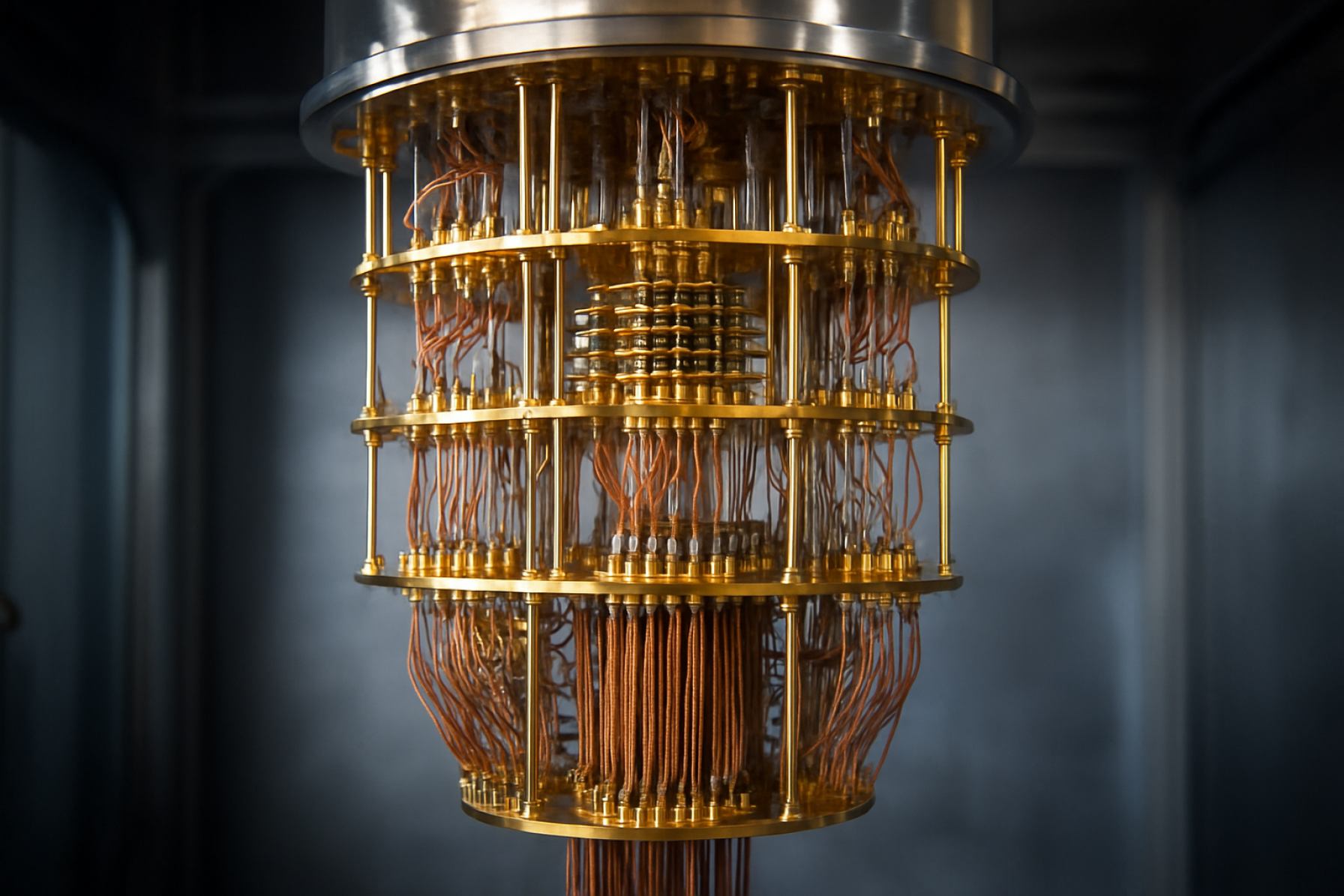

Cryogenic quantum computing hardware is foundational to the operation of many leading quantum computing platforms, particularly those based on superconducting qubits and spin qubits. The core principle underpinning this technology is the necessity to maintain quantum processors at extremely low temperatures—often below 20 millikelvin—to suppress thermal noise and decoherence, thereby preserving quantum states long enough for computation. This is achieved using advanced cryogenic systems, most notably dilution refrigerators, which have become a critical component in the quantum computing hardware stack.

In 2025, the field is witnessing rapid advancements in both the scale and reliability of cryogenic systems. Companies such as Bluefors Oy and Oxford Instruments plc are at the forefront, supplying dilution refrigerators capable of supporting hundreds of qubits. These systems are engineered for high cooling power, low vibration, and modularity, enabling integration with increasingly complex quantum processors. Bluefors Oy, for example, has partnered with major quantum computing firms to deliver cryostats that support large-scale quantum processors, while Oxford Instruments plc continues to innovate in cryogenic engineering, focusing on automation and remote monitoring to facilitate continuous operation and minimize downtime.

The demand for robust cryogenic infrastructure is driven by the scaling ambitions of quantum hardware leaders such as International Business Machines Corporation (IBM) and Google LLC. Both companies rely on dilution refrigerators to house their superconducting quantum processors, with IBM’s “Quantum System Two” and Google’s Sycamore platform exemplifying the integration of advanced cryogenics with quantum hardware. These systems require not only ultra-low temperatures but also precise thermal management and electromagnetic shielding, which are being addressed through collaborative engineering efforts with cryogenics specialists.

Looking ahead, the next few years are expected to bring further innovations in cryogenic quantum computing hardware. Efforts are underway to develop more energy-efficient cooling systems, reduce the physical footprint of dilution refrigerators, and enhance the automation of cryogenic operations. Additionally, new materials and wiring solutions are being explored to minimize heat load and improve signal integrity between room-temperature electronics and cryogenic environments. As quantum processors scale toward thousands of qubits, the evolution of cryogenic hardware will remain a linchpin for the industry’s progress, with ongoing contributions from both established suppliers and emerging technology developers.

Leading Players and Strategic Partnerships (e.g., ibm.com, intel.com, delft.cqte.nl)

The cryogenic quantum computing hardware sector is characterized by a dynamic landscape of leading players and strategic partnerships, as the race to build scalable, fault-tolerant quantum computers intensifies into 2025 and beyond. The field is dominated by a handful of technology giants, specialized hardware manufacturers, and research-driven startups, each leveraging unique expertise in cryogenics, superconducting circuits, and quantum device integration.

Among the most prominent is IBM, which continues to advance its superconducting quantum processors, all of which require operation at millikelvin temperatures. IBM’s “Quantum System Two,” unveiled in late 2023, integrates modular cryogenic infrastructure and is designed for scaling up to thousands of qubits. The company’s roadmap through 2025 includes further collaborations with cryogenic component suppliers and research institutions to address challenges in thermal management and wiring density.

Intel is another major player, focusing on silicon spin qubits and leveraging its semiconductor fabrication expertise. Intel’s “Horse Ridge” cryogenic control chip, developed in partnership with QuTech (a collaboration between Delft University of Technology and TNO), is designed to operate at temperatures below 4 Kelvin, reducing the complexity and cost of wiring in large-scale quantum systems. Intel’s ongoing partnerships with cryogenic refrigeration specialists and European research consortia are expected to yield further hardware integration breakthroughs by 2025.

In Europe, Delft Circuits has emerged as a key supplier of cryogenic cabling and interconnects, with its “Cri/oFlex” technology now widely adopted in quantum labs and commercial systems. The company collaborates with leading quantum hardware developers to optimize signal fidelity and thermal performance, and is expanding its manufacturing capacity to meet growing demand.

Strategic partnerships are also shaping the sector’s trajectory. For example, Oxford Instruments supplies dilution refrigerators and cryogenic platforms to quantum computing companies worldwide, and has entered into joint development agreements with both academic and industrial partners to co-design next-generation cryostats tailored for quantum processors. Similarly, Bluefors is a leading provider of cryogenic systems, supporting a global customer base that includes major quantum hardware developers and national laboratories.

Looking ahead, the next few years are expected to see deeper integration between quantum processor designers, cryogenic hardware manufacturers, and control electronics specialists. This collaborative approach is essential for overcoming the engineering bottlenecks of scaling quantum computers, and is likely to drive further consolidation and cross-border partnerships as the industry matures.

Current Hardware Architectures: Superconducting, Spin Qubits, and Beyond

Cryogenic quantum computing hardware is at the heart of the race to build scalable, fault-tolerant quantum computers. As of 2025, the field is dominated by two primary qubit modalities: superconducting circuits and spin qubits, each requiring sophisticated cryogenic environments to maintain quantum coherence and minimize noise. These architectures are being actively developed by leading technology companies and research institutions, with significant progress in both performance and manufacturability.

Superconducting qubits, which operate at temperatures near 10 millikelvin, remain the most mature and widely deployed architecture. IBM has been a pioneer, with its IBM Quantum System One and the recently announced IBM Quantum System Two, both leveraging dilution refrigerators to house increasingly complex superconducting qubit chips. In 2024, IBM unveiled a 1,121-qubit processor, “Condor,” and has outlined a roadmap to scale up to 10,000+ qubits by the late 2020s. Rigetti Computing and Quantinuum are also advancing superconducting platforms, focusing on improving qubit connectivity, error rates, and integration with cryogenic control electronics.

Spin qubits, particularly those based on silicon, are gaining momentum due to their compatibility with existing semiconductor manufacturing processes. Intel has demonstrated silicon spin qubit arrays operating at millikelvin temperatures, leveraging its advanced fabrication capabilities to push towards higher yields and uniformity. Quantum Brilliance is exploring diamond-based spin qubits, which can operate at higher temperatures (up to a few kelvin), potentially reducing cooling requirements and system complexity.

Beyond these leading modalities, alternative cryogenic hardware approaches are emerging. Paul Scherrer Institute and other research organizations are investigating hybrid systems that combine superconducting and spin qubits, aiming to harness the advantages of both. Additionally, companies like Bluefors and Oxford Instruments are innovating in cryogenic infrastructure, developing dilution refrigerators and cryostats with higher cooling power, lower vibration, and improved integration for large-scale quantum processors.

Looking ahead, the next few years will see continued refinement of cryogenic quantum hardware, with a focus on scaling up qubit numbers, reducing error rates, and integrating cryogenic control electronics. The interplay between hardware advances and cryogenic engineering will be critical to achieving practical, large-scale quantum computing systems by the end of the decade.

Cryogenic Infrastructure: Dilution Refrigerators, Control Electronics, and Integration

Cryogenic infrastructure is foundational to the operation of quantum computing hardware, particularly for superconducting and spin-based qubits, which require temperatures near absolute zero to maintain quantum coherence. As of 2025, the sector is witnessing rapid advancements in dilution refrigerators, cryogenic control electronics, and system integration, driven by the scaling ambitions of both established quantum hardware companies and specialized cryogenics manufacturers.

Dilution refrigerators remain the workhorse for cooling quantum processors to millikelvin temperatures. The market is led by companies such as Bluefors and Oxford Instruments, both of which have expanded their product lines to support larger payloads and higher cooling power, addressing the needs of multi-qubit and modular quantum systems. In 2024 and 2025, Bluefors introduced new models with enhanced wiring capacity and improved thermalization, enabling integration of hundreds to thousands of qubits. Oxford Instruments has similarly focused on scalable platforms, collaborating with quantum processor developers to optimize refrigerator architecture for high-density wiring and low-vibration environments.

Cryogenic control electronics are another critical area of innovation. Traditional room-temperature electronics face significant challenges in scaling due to signal attenuation and thermal load from cabling. To address this, companies like Intel Corporation and Cryomind are developing cryo-CMOS and other low-temperature-compatible control chips. Intel Corporation has demonstrated cryogenic controllers capable of operating at 4K and below, reducing the need for extensive wiring and improving signal fidelity. These advances are expected to be pivotal for scaling quantum processors beyond the current 100-qubit range.

Integration of cryogenic infrastructure with quantum processors is increasingly a collaborative effort. Major quantum computing companies such as IBM and Rigetti Computing are working closely with cryogenics suppliers to co-design systems that optimize for both quantum performance and operational reliability. For example, IBM’s “super-fridge” project aims to support future quantum processors with over 100,000 qubits, requiring unprecedented cooling power and system integration.

Looking ahead, the next few years will likely see further convergence between cryogenic hardware and quantum processor design, with a focus on modularity, automation, and remote operation. The emergence of standardized cryogenic platforms and plug-and-play integration will be key enablers for the commercialization and broader deployment of quantum computing systems.

Market Forecasts: Growth Projections Through 2030

The market for cryogenic quantum computing hardware is poised for significant growth through 2030, driven by increasing investments in quantum technologies, advances in superconducting qubit architectures, and the expanding ecosystem of hardware suppliers. As of 2025, the sector is characterized by a handful of leading companies and research institutions that are scaling up their manufacturing capabilities and deepening collaborations with both public and private stakeholders.

Key players such as IBM, Intel, and Rigetti Computing are at the forefront of developing superconducting quantum processors, which require sophisticated cryogenic systems to operate at millikelvin temperatures. These companies are investing heavily in next-generation dilution refrigerators and integrated cryogenic control electronics, aiming to support quantum processors with hundreds or even thousands of qubits by the end of the decade. IBM has publicly committed to a roadmap that includes scaling up to 1,000+ qubit systems, with commercial deployment targets set for the late 2020s.

The cryogenic hardware supply chain is also expanding, with specialized manufacturers such as Bluefors and Oxford Instruments providing advanced dilution refrigerators and cryogenic infrastructure. These companies are reporting increased demand from both established quantum computing firms and new entrants, reflecting the sector’s rapid maturation. Bluefors, for example, has announced capacity expansions and new product lines tailored for scalable quantum computing applications.

Looking ahead, the market outlook through 2030 is shaped by several factors:

- Continued government funding and strategic initiatives in the US, EU, and Asia, supporting both research and commercialization of quantum hardware.

- Ongoing technical progress in cryogenic engineering, including more energy-efficient cooling systems and improved integration with quantum processors.

- Emergence of new players and partnerships, particularly as semiconductor and electronics giants such as Intel and Infineon Technologies deepen their involvement in quantum hardware supply chains.

- Growing demand from cloud-based quantum computing services, which require robust, scalable, and reliable cryogenic infrastructure to support multi-user access and hybrid quantum-classical workflows.

By 2030, industry consensus anticipates a multi-billion dollar market for cryogenic quantum computing hardware, with annual growth rates in the double digits as quantum processors move from laboratory prototypes to commercial deployment. The sector’s trajectory will depend on continued innovation in both quantum device fabrication and cryogenic system engineering, as well as the ability of suppliers to meet the stringent reliability and performance requirements of next-generation quantum computers.

Emerging Innovations: Materials, Miniaturization, and Energy Efficiency

Cryogenic quantum computing hardware is undergoing rapid innovation, with a strong focus on materials science, device miniaturization, and energy efficiency. As quantum processors require temperatures near absolute zero to maintain qubit coherence, advances in cryogenic engineering are pivotal for scaling up quantum systems in the coming years.

In 2025, leading quantum hardware developers are pushing the boundaries of superconducting and semiconducting materials. IBM continues to refine its transmon qubit designs, leveraging high-purity aluminum and niobium films to reduce decoherence and improve gate fidelities. Delft University of Technology and Intel Corporation are advancing silicon spin qubits, which promise higher integration densities and compatibility with established semiconductor fabrication processes. These material innovations are critical for increasing qubit counts while maintaining manageable error rates.

Miniaturization is another key trend, as quantum processors transition from laboratory prototypes to scalable architectures. Rigetti Computing and Oxford Quantum Circuits are developing compact, modular cryogenic platforms that integrate control electronics closer to the qubit layer, reducing signal loss and thermal load. Bluefors, a leading supplier of dilution refrigerators, is collaborating with quantum hardware companies to design cryostats with higher cooling power and smaller footprints, enabling denser qubit arrays and more efficient system integration.

Energy efficiency is increasingly in focus as quantum computers scale. Traditional cryogenic systems consume significant power to maintain millikelvin temperatures. To address this, Oxford Instruments is introducing next-generation cryogenic solutions with improved thermal insulation and lower input power requirements. Meanwhile, Seeqc is pioneering cryogenic classical control chips, which operate at the same low temperatures as the qubits, drastically reducing the need for heat-generating cabling and room-temperature electronics.

Looking ahead, the convergence of advanced materials, miniaturized cryogenic infrastructure, and energy-efficient control electronics is expected to accelerate the deployment of practical quantum computers. Industry roadmaps suggest that by the late 2020s, quantum processors with thousands of high-fidelity qubits could become feasible, provided that cryogenic hardware continues to evolve in tandem with quantum device architectures. The next few years will be critical for demonstrating scalable, reliable, and energy-conscious cryogenic quantum computing platforms.

Commercialization Pathways: From Research Labs to Scalable Deployment

Cryogenic quantum computing hardware is at the heart of the race to achieve practical, scalable quantum computers. As of 2025, the commercialization pathway for these systems is defined by a transition from bespoke laboratory setups to robust, manufacturable platforms capable of supporting hundreds or thousands of qubits. This transition is driven by both established technology leaders and a new generation of specialized hardware companies.

The core challenge in commercializing quantum hardware lies in maintaining qubit coherence and fidelity at millikelvin temperatures, typically below 20 mK. This requires advanced dilution refrigerators and highly integrated cryogenic control electronics. Bluefors Oy has emerged as a global leader in cryogenic infrastructure, supplying dilution refrigerators to most major quantum computing research groups and commercial ventures. Their systems are now being adapted for higher cooling power and modularity, supporting the scaling ambitions of quantum processor manufacturers.

On the quantum processor side, International Business Machines Corporation (IBM) continues to push the envelope with its roadmap for superconducting qubit systems. In 2023, IBM unveiled its 1,121-qubit “Condor” chip, and by 2025, the company is targeting the deployment of modular quantum systems with thousands of qubits, leveraging advanced cryogenic packaging and integration. IBM’s approach includes the development of cryo-CMOS control chips, which are essential for reducing the wiring complexity and thermal load inside dilution refrigerators.

Similarly, Intel Corporation is advancing its “Horse Ridge” cryogenic control technology, aiming to integrate more control electronics at cryogenic temperatures. This integration is expected to be a key enabler for scaling up quantum processors, as it minimizes the need for extensive room-temperature wiring and improves signal integrity.

Another notable player is Oxford Instruments plc, which provides cryogenic and measurement solutions tailored for quantum hardware developers. Their recent collaborations with quantum processor startups and national labs are accelerating the standardization of cryogenic platforms, a necessary step for broader commercial deployment.

Looking ahead, the next few years will likely see the emergence of more turnkey cryogenic quantum computing systems, with improved reliability, automation, and serviceability. The convergence of cryogenic engineering, quantum processor design, and integrated control electronics is expected to lower barriers for new entrants and enable pilot deployments in industry and government. As these systems mature, the focus will shift from laboratory demonstration to scalable, repeatable manufacturing and field operation, marking a critical inflection point in the commercialization of quantum computing hardware.

Regulatory, Standardization, and Industry Initiatives (e.g., ieee.org, qutech.nl)

The rapid evolution of cryogenic quantum computing hardware has prompted significant regulatory, standardization, and industry coordination efforts, particularly as the sector approaches broader commercialization in 2025 and beyond. The unique requirements of quantum systems—such as ultra-low temperature operation, specialized materials, and integration with classical electronics—necessitate new frameworks and collaborative initiatives to ensure interoperability, safety, and scalability.

One of the most prominent organizations in this space is the IEEE, which has established the Quantum Initiative to develop standards for quantum technologies, including cryogenic hardware. The IEEE P7130 working group, for example, is focused on defining a standard for quantum computing terminology, which is foundational for subsequent hardware-specific standards. In 2024 and 2025, the IEEE is expected to expand its efforts to address cryogenic interconnects, thermal management, and system integration, reflecting the growing complexity of quantum processors and their supporting infrastructure.

In Europe, QuTech—a leading quantum research institute based in the Netherlands—has played a pivotal role in fostering industry-wide collaboration. QuTech is a founding member of the European Quantum Industry Consortium (QuIC), which brings together hardware manufacturers, cryogenics specialists, and end-users to align on technical requirements and best practices. In 2025, QuTech and its partners are anticipated to release updated guidelines for cryogenic system interoperability, focusing on modularity and compatibility between quantum processors and dilution refrigerators.

On the manufacturing side, companies such as IBM and Bluefors are actively participating in standardization efforts. IBM, a leader in superconducting quantum hardware, has advocated for open interfaces and published technical specifications for its quantum systems to encourage ecosystem development. Bluefors, a major supplier of cryogenic refrigeration systems, collaborates with both academic and industrial partners to define safety and performance benchmarks for dilution refrigerators, which are critical for maintaining the sub-20 millikelvin environments required by many quantum processors.

Looking ahead, regulatory bodies in the US, EU, and Asia are expected to increase their engagement with quantum hardware stakeholders. This includes the development of certification schemes for cryogenic components and the establishment of cross-border protocols for the secure transport and operation of quantum systems. As quantum computing hardware matures, these regulatory and standardization initiatives will be essential for ensuring reliability, fostering innovation, and enabling the global scaling of cryogenic quantum technologies.

Future Outlook: Challenges, Opportunities, and the Road to Quantum Advantage

Cryogenic quantum computing hardware is poised to remain a cornerstone of quantum technology development through 2025 and the following years, as the industry pursues the elusive goal of quantum advantage. The need to maintain qubits—whether superconducting, spin, or topological—at millikelvin temperatures continues to drive innovation in cryogenic engineering, materials science, and system integration.

Key players such as IBM, Bluefors, Oxford Instruments, and Quantum Machines are investing heavily in next-generation dilution refrigerators, cryogenic control electronics, and scalable wiring solutions. IBM’s 2024 unveiling of its 1,121-qubit “Condor” processor, housed in a custom cryostat, exemplifies the scale and complexity of modern cryogenic systems. Bluefors and Oxford Instruments are expanding their product lines to support larger payloads, higher cooling power, and improved automation, anticipating the needs of multi-thousand-qubit processors.

Despite these advances, several challenges persist. The sheer volume of cabling and control lines required for large-scale quantum processors introduces heat loads and noise, threatening qubit coherence. Companies like Quantum Machines are developing cryo-CMOS and integrated control solutions to minimize thermal footprints and enable more efficient scaling. Material impurities, vibration, and electromagnetic interference remain significant hurdles, prompting ongoing research into new shielding techniques and ultra-pure materials.

Opportunities abound for suppliers of cryogenic infrastructure, as demand for robust, modular, and serviceable systems grows. The emergence of “quantum data centers”—centralized facilities optimized for hosting multiple quantum processors—could drive standardization and economies of scale in cryogenic hardware. Partnerships between hardware manufacturers and quantum computing companies are intensifying, with IBM and Bluefors collaborating on next-generation cooling platforms.

Looking ahead, the path to quantum advantage will likely hinge on breakthroughs in cryogenic integration and reliability. The next few years are expected to see the introduction of more compact, energy-efficient cryostats, as well as the first commercial deployments of cryogenic quantum computers outside laboratory settings. As the ecosystem matures, the interplay between hardware innovation and quantum algorithm development will be critical, with cryogenic technology remaining a key enabler of progress toward practical quantum computing.

Sources & References

- IBM

- Oxford Instruments

- Quantum Design

- Bluefors

- Google LLC

- IBM

- QuTech

- Oxford Instruments

- Bluefors

- Rigetti Computing

- Quantinuum

- Paul Scherrer Institute

- Infineon Technologies

- Rigetti Computing

- Seeqc

- IEEE

- QuTech